What’s Up With My Tax Return Status? The Ultimate Guide To Understanding Your Mo Tax Return

Alright, let's get down to business—your tax return status is one of the most nerve-wracking things to check, especially when you're waiting for that sweet refund. Whether you're in Missouri or any other state, knowing where your tax return stands is crucial. In this guide, we're going deep into the world of mo tax return status, breaking it down step by step so you can breathe a little easier. Stick around, because this is gonna be good.

First things first, let’s talk about why your mo tax return status matters so much. Everyone’s got bills to pay, vacations to plan, or maybe just a new pair of sneakers they’ve been eyeing. Whatever your reason, understanding your tax return process is key to managing your finances without losing your mind. And trust me, I’ve been there.

Now, here’s the deal: navigating the IRS website or Missouri’s tax portal can feel like trying to decode ancient hieroglyphics. But don’t worry, we’re gonna break it all down for you. From checking your status to troubleshooting common issues, this guide has got your back. So grab a coffee, sit tight, and let’s dive in.

Read also:Why Community Colleges In Katy Are A Gamechanger For Students

Table of Contents

- Biography of Tax Filing

- Understanding Your Mo Tax Return Status

- Steps to Check Your Tax Return Status

- Common Issues with Tax Returns

- Solutions to Tax Return Problems

- IRS Guidelines for Missouri

- Tips for Filing Your Taxes

- Federal vs. State Tax Returns

- Maximizing Your Tax Deductions

- Conclusion: Staying on Top of Your Mo Tax Return

Biography of Tax Filing

Taxes have been around since the beginning of time—or at least it feels that way. In Missouri, just like in every other state, the tax system is designed to make sure everyone contributes their fair share. But let’s face it, filing taxes can be a headache. Here’s a quick breakdown of how the process works:

History of Taxation

Taxation dates back thousands of years, with ancient civilizations like the Egyptians and Romans implementing systems to collect revenue. Fast forward to today, and we’ve got a whole new level of complexity. Missouri, in particular, has its own set of rules and regulations when it comes to state taxes.

So, why do we even have taxes? Well, they fund everything from schools to roads, healthcare, and public safety. It’s not always fun, but it’s necessary. And hey, if you’re lucky, you might even get a refund. Now, let’s focus on the main event—your mo tax return status.

Understanding Your Mo Tax Return Status

Checking your mo tax return status is like waiting for a package to arrive. You know it’s on the way, but you just want to make sure everything’s going smoothly. Here’s what you need to know:

What Does Your Tax Return Status Mean?

Your tax return status gives you an update on where your refund stands. It typically goes through several stages:

- Received: The IRS or Missouri Department of Revenue has received your tax return.

- Processing: They’re reviewing your information to ensure everything’s accurate.

- Approved: Your refund has been approved and is ready to be sent out.

- Sent: Your refund is on its way to you, either via direct deposit or a paper check.

Each stage can take a few days to a couple of weeks, so patience is key. But if something seems off, don’t panic—there are steps you can take.

Read also:Ariana Grande Rare Photos A Behindthescenes Look At Her Iconic Moments

Steps to Check Your Tax Return Status

Alright, here’s the part you’ve been waiting for—how to check your mo tax return status. Follow these steps to stay informed:

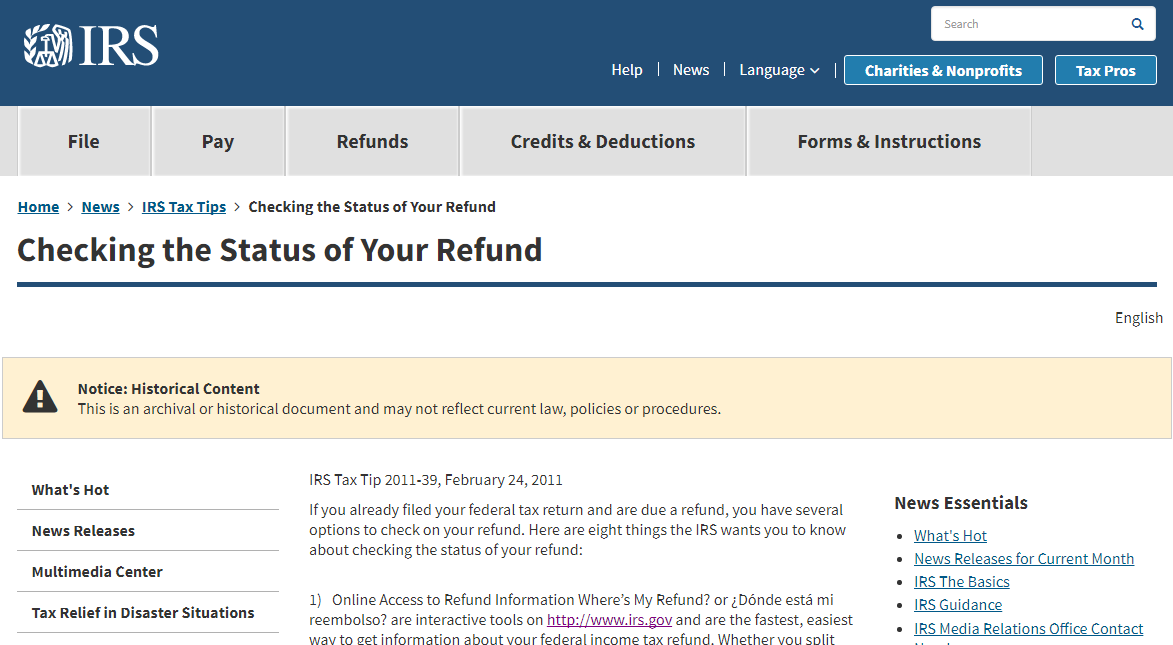

Using the IRS Website

Head over to the IRS’s official website and look for the “Where’s My Refund?” tool. You’ll need:

- Your Social Security Number (SSN)

- Your filing status (single, married filing jointly, etc.)

- The exact amount of your expected refund

Once you enter this info, the tool will give you a detailed update on your refund’s progress. Easy peasy.

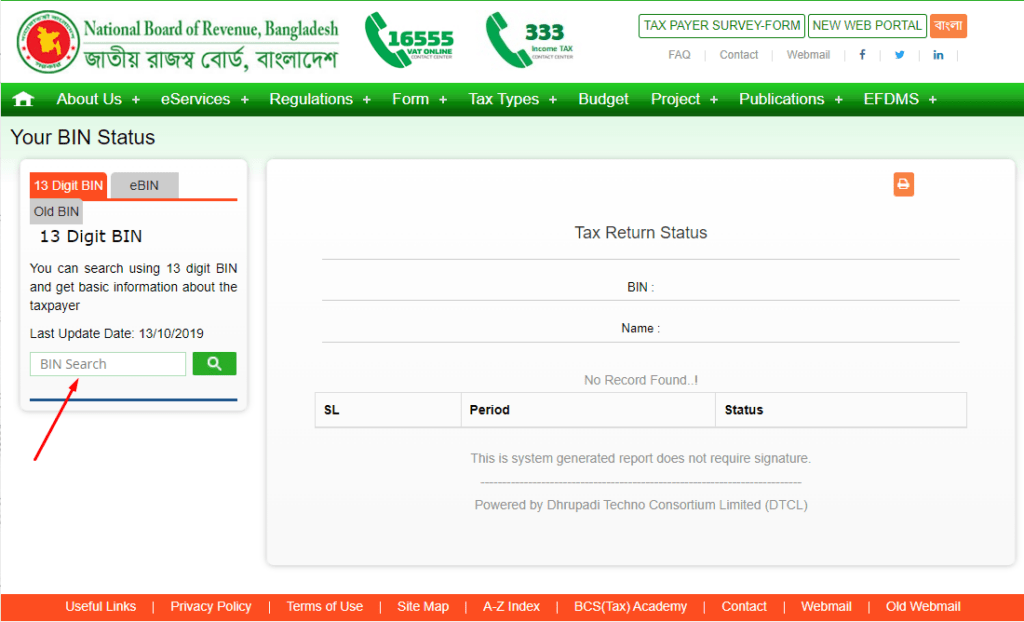

Checking Missouri’s Portal

If you filed a state tax return in Missouri, you can also check your status through the Missouri Department of Revenue’s website. Similar to the IRS, you’ll need your SSN and the amount of your refund.

Common Issues with Tax Returns

Let’s face it, not everything goes smoothly all the time. Here are some common issues people run into when checking their mo tax return status:

Delayed Refunds

Sometimes, refunds can get delayed due to errors in your tax return or additional reviews by the IRS. If this happens, don’t freak out—just double-check your information and contact the IRS if necessary.

Incorrect Information

Entering the wrong SSN or refund amount can cause delays. Always triple-check your info before submitting your return.

Solutions to Tax Return Problems

Now that we’ve covered the problems, let’s talk solutions. Here’s what you can do if you’re having trouble with your mo tax return status:

Contacting the IRS

If you’ve waited more than 21 days and still haven’t received your refund, it’s time to reach out to the IRS. They’ve got customer service reps ready to help you troubleshoot any issues.

Consulting a Tax Professional

Sometimes, it’s best to leave the heavy lifting to the experts. A certified tax professional can review your return and help resolve any problems quickly.

IRS Guidelines for Missouri

The IRS has specific guidelines for each state, including Missouri. Here are a few key points to keep in mind:

State Tax Rates

Missouri’s state income tax rates range from 1.5% to 5.4%. Make sure you’re calculating your taxes correctly to avoid any surprises.

Deadlines

The federal tax deadline is usually April 15th, but Missouri has its own deadlines as well. Stay on top of these dates to avoid penalties.

Tips for Filing Your Taxes

Filing your taxes doesn’t have to be a nightmare. Here are some tips to make the process smoother:

Organize Your Documents

Keep all your tax documents in one place—W-2s, 1099s, receipts, you name it. This will save you a ton of time when it comes to filing.

File Early

The earlier you file, the sooner you’ll get your refund. Plus, you’ll avoid the last-minute rush.

Federal vs. State Tax Returns

Understanding the difference between federal and state tax returns is important. While the IRS handles federal taxes, each state has its own system. Missouri, for example, has its own set of forms and deadlines.

Key Differences

Here are a few key differences to keep in mind:

- Federal taxes fund national programs, while state taxes fund local initiatives.

- State tax rates can vary significantly from federal rates.

- Some deductions and credits are only available at the state level.

Maximizing Your Tax Deductions

Who doesn’t love saving money? Here’s how you can maximize your tax deductions:

Standard vs. Itemized Deductions

You can choose between taking the standard deduction or itemizing your deductions. Depending on your situation, one might be more beneficial than the other.

Common Deductions

Some common deductions include mortgage interest, charitable contributions, and student loan interest. Make sure you’re taking advantage of all the deductions you qualify for.

Conclusion: Staying on Top of Your Mo Tax Return

And there you have it—the ultimate guide to understanding your mo tax return status. From checking your status to troubleshooting common issues, this guide has covered all the bases. Remember, patience is key, but if something seems off, don’t hesitate to take action.

Now, here’s the fun part—what’s next? Leave a comment below and let me know if you’ve got any questions or tips of your own. And don’t forget to share this article with your friends who might be stressing about their tax returns. Together, we can make tax season a little less painful.

Article Recommendations