Unlock Your Home's Potential: A Comprehensive Guide To Umpqua Home Equity Line Of Credit

Hey there, homeowners! If you're looking to tap into the value of your home and need a flexible financing option, the Umpqua Home Equity Line of Credit (HELOC) might just be your golden ticket. This financial tool is like having a personal piggy bank tied to your house, allowing you to access funds whenever you need them. Let’s dive into how it works, why it matters, and how you can make the most out of it.

Nowadays, more and more people are turning to HELOCs as a smart way to manage their finances. Whether you're planning a home renovation, paying off high-interest debt, or even funding a dream vacation, an Umpqua Home Equity Line of Credit gives you the flexibility to borrow what you need, when you need it.

But hey, before we jump into the nitty-gritty details, let’s set the stage. This article is designed to be your ultimate guide to understanding what a Umpqua Home Equity Line of Credit is, how it works, and why it could be the perfect solution for your financial goals. So grab a coffee, get comfy, and let’s explore this powerful financial tool together!

Read also:Kavanagh Brothers Notre Dame A Tale Of Triumph And Legacy

What Exactly is a Umpqua Home Equity Line of Credit?

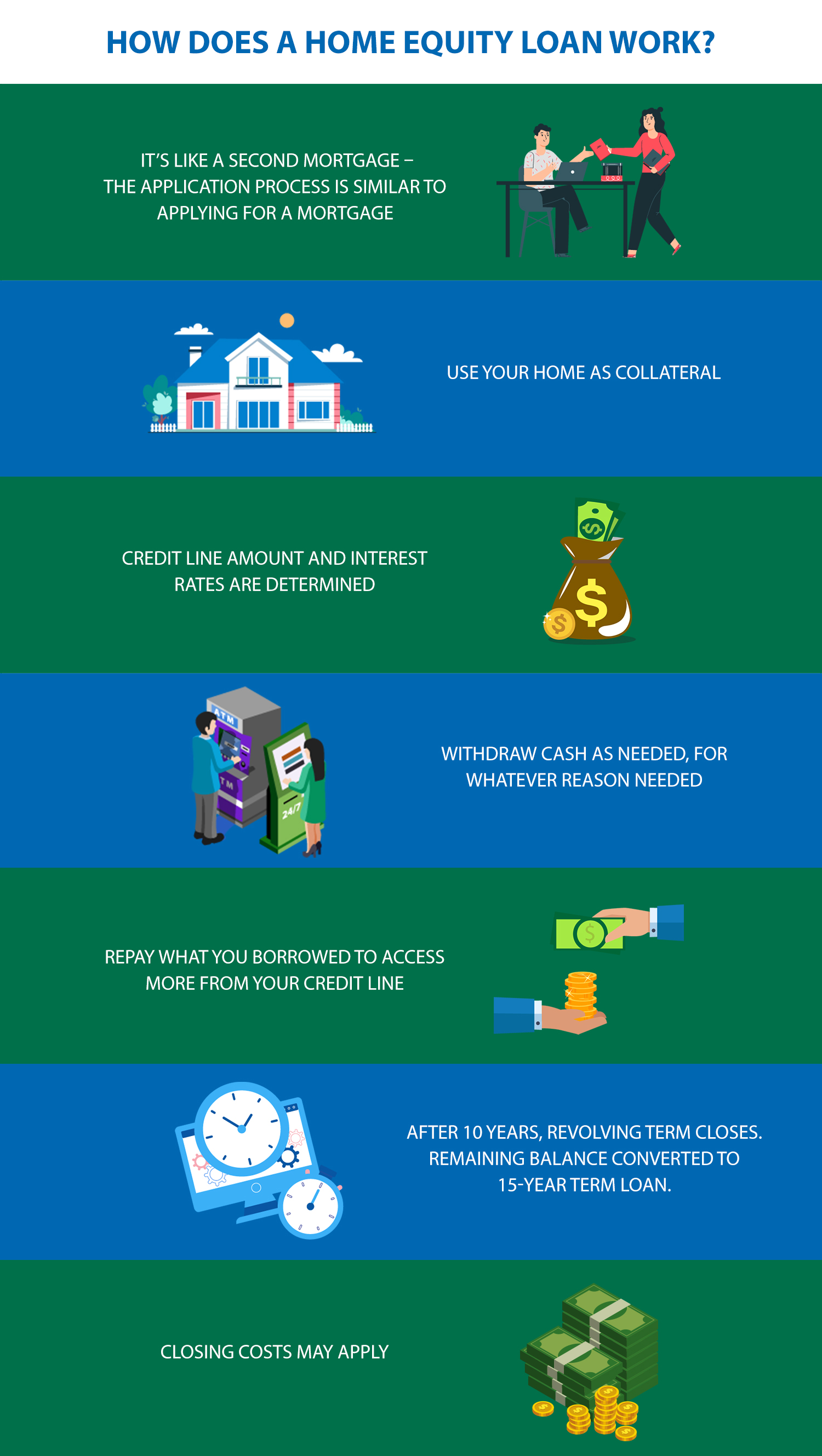

A Umpqua Home Equity Line of Credit, or HELOC, is essentially a revolving line of credit that uses your home as collateral. Think of it as a credit card, but instead of swiping plastic, you’re borrowing against the equity in your house. The amount you can borrow depends on several factors, including the value of your home, your credit score, and your current financial situation.

Here’s the kicker: unlike a traditional home equity loan, which gives you a lump sum of cash upfront, a HELOC allows you to draw funds as needed over a set period of time, usually 5 to 10 years. This is called the "draw period." Once the draw period ends, you enter the repayment phase, where you start paying back the money you’ve borrowed, plus interest.

Now, let’s break it down even further:

- Revolving Credit: You can borrow, repay, and borrow again during the draw period.

- Variable Interest Rates: The interest rate on your HELOC can fluctuate based on market conditions.

- Flexible Payments: During the draw period, you might only need to pay interest on the amount you’ve borrowed, making it easier on your wallet.

Why Choose Umpqua Home Equity Line of Credit?

So, why should you consider an Umpqua HELOC over other financing options? Well, there are a few key advantages that make it stand out:

1. Competitive Rates: Umpqua offers some of the most competitive rates in the market, which means you’ll save money on interest over time.

2. Flexibility: Unlike a fixed-rate loan, a HELOC gives you the freedom to borrow only what you need, when you need it. This can be a game-changer for big projects or unexpected expenses.

Read also:Central East Maui Little League The Heart Of Youth Baseball In Paradise

3. Local Expertise: Umpqua Bank has deep roots in the community, meaning you’ll get personalized service and support from people who understand your local market.

How Does Umpqua HELOC Compare to Other Options?

When it comes to tapping into your home’s equity, you’ve got a few options: a home equity loan, a cash-out refinance, or a HELOC. Each has its own pros and cons, but here’s why a Umpqua HELOC might be the best choice:

- Home Equity Loan: Offers a fixed rate and fixed payments, but you get the money all at once, which might not be ideal if you don’t need it all right away.

- Cash-Out Refinance: Replaces your existing mortgage with a new one, giving you cash upfront. This can be a good option if you want to lower your interest rate, but it comes with closing costs.

- Umpqua HELOC: Provides flexibility, competitive rates, and no upfront costs, making it a great choice for homeowners who want access to funds without committing to a large lump sum.

Eligibility Requirements for Umpqua HELOC

Before you dive headfirst into applying for an Umpqua Home Equity Line of Credit, it’s important to know if you qualify. Here are some of the key requirements:

1. Home Equity: You’ll need to have enough equity in your home to qualify. Typically, lenders require you to have at least 20% equity, but Umpqua might offer more flexible terms depending on your situation.

2. Credit Score: A good credit score is essential. While Umpqua doesn’t publicly disclose their exact requirements, a score of 680 or higher will generally improve your chances of approval.

3. Debt-to-Income Ratio: Lenders will look at your DTI ratio to ensure you can handle the additional debt. Ideally, your DTI should be below 43%.

4. Stable Income: You’ll need to demonstrate a steady income source to prove you can repay the line of credit.

Tips for Improving Your Chances of Approval

Here are a few tips to boost your chances of getting approved for an Umpqua HELOC:

- Pay Down Existing Debt: Reducing your overall debt burden can improve your DTI ratio and make you a more attractive candidate.

- Boost Your Credit Score: Pay your bills on time, dispute any errors on your credit report, and avoid opening new credit accounts before applying.

- Document Your Income: Be prepared to provide proof of income, such as pay stubs, tax returns, or bank statements.

How Much Can You Borrow with Umpqua HELOC?

The amount you can borrow with an Umpqua Home Equity Line of Credit depends on several factors, including:

1. Home Value: The current market value of your home plays a big role in determining your borrowing limit. Umpqua will likely conduct an appraisal to assess your home’s worth.

2. Loan-to-Value Ratio (LTV): This is the percentage of your home’s value that you’re borrowing against. Most lenders cap LTV at 80%, but Umpqua might offer higher limits for well-qualified borrowers.

3. Creditworthiness: Your credit score, income, and debt levels will all factor into how much you can borrow.

Example Scenario

Let’s say your home is worth $500,000, and you currently owe $300,000 on your mortgage. That means you have $200,000 in equity. If Umpqua allows an LTV of 80%, you could potentially borrow up to $100,000 through a HELOC. Pretty sweet, right?

How to Apply for Umpqua Home Equity Line of Credit

Applying for an Umpqua HELOC is a straightforward process, but it does require some preparation. Here’s what you’ll need to do:

1. Gather Your Documents: You’ll need to provide proof of income, bank statements, tax returns, and any other financial information requested by Umpqua.

2. Complete the Application: You can apply online, over the phone, or in person at an Umpqua branch. The application will ask for details about your property, income, and financial situation.

3. Wait for Approval: Once your application is submitted, Umpqua will review it and let you know if you’re approved. This process can take a few weeks, so be patient.

What Happens After Approval?

Once you’re approved, Umpqua will set up your line of credit and provide you with a checkbook or card to access your funds. You’ll also receive detailed information about your interest rate, repayment terms, and any fees associated with the HELOC.

Common Questions About Umpqua HELOC

Still have some burning questions about Umpqua Home Equity Line of Credit? Here are some of the most frequently asked questions:

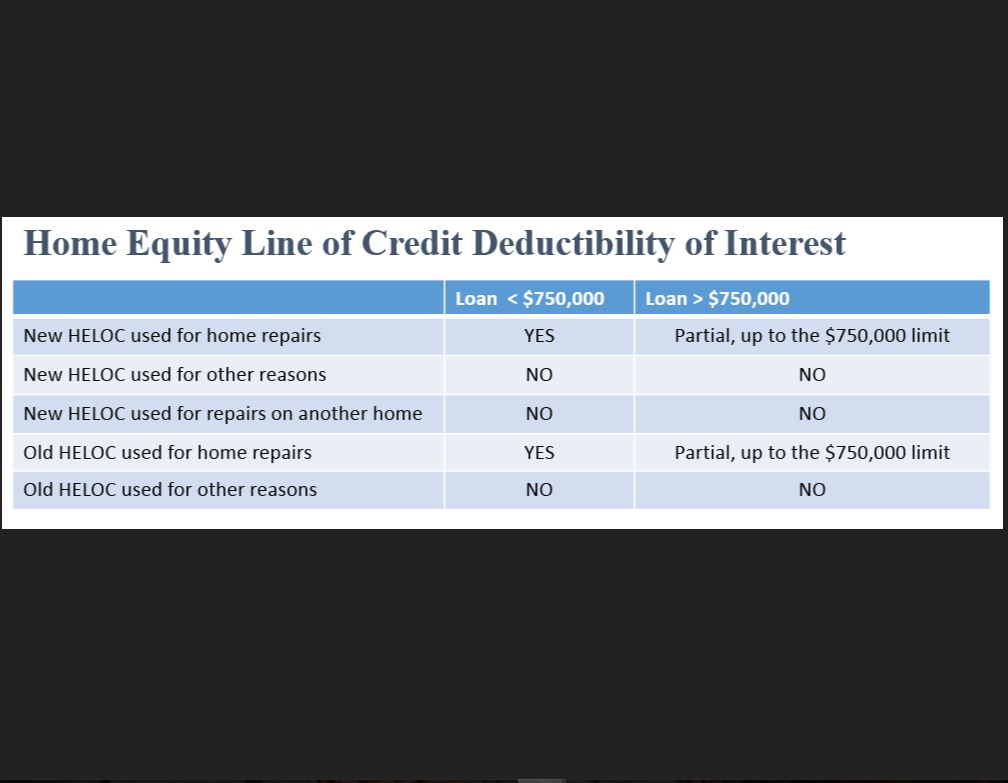

Q: Can I use a HELOC for anything?

A: Technically, yes. While many people use HELOCs for home improvements, debt consolidation, or education expenses, you can technically use the funds for anything you want. Just keep in mind that your home is on the line if you default.

Q: What happens if I sell my home while I have a HELOC?

A: If you sell your home, you’ll need to pay off the outstanding balance on your HELOC before you can close the sale. Any remaining equity will go to you.

Q: Are there any fees associated with a HELOC?

A: Some lenders charge origination fees, appraisal fees, or annual maintenance fees. Be sure to ask Umpqua about any potential costs before signing on the dotted line.

What to Watch Out For

While a HELOC can be a powerful financial tool, there are a few things to be aware of:

- Variable Interest Rates: If market rates rise, so will your HELOC interest rate.

- Risk of Foreclosure: If you can’t repay your HELOC, you could lose your home.

- Overborrowing: It’s easy to get carried away with the flexibility of a HELOC, so be sure to borrow only what you need.

Alternatives to Umpqua HELOC

While an Umpqua Home Equity Line of Credit might be the right choice for many homeowners, it’s not the only option. Here are a few alternatives to consider:

1. Personal Loan: If you need a smaller amount of money and don’t want to use your home as collateral, a personal loan could be a good option.

2. Home Equity Loan: For those who prefer fixed payments and a lump sum of cash, a home equity loan might be a better fit.

3. Cash-Out Refinance: If you want to lower your mortgage rate and tap into your home’s equity at the same time, a cash-out refinance could be worth exploring.

Which Option is Right for You?

Ultimately, the best choice depends on your financial goals, risk tolerance, and current situation. Be sure to weigh the pros and cons of each option before making a decision.

Conclusion: Is Umpqua HELOC Right for You?

Alright, let’s wrap this up. An Umpqua Home Equity Line of Credit can be a fantastic way to access the equity in your home and achieve your financial goals. With its flexibility, competitive rates, and local expertise, it’s no wonder so many homeowners are turning to Umpqua for their financing needs.

But remember, a HELOC is a serious financial commitment. Before you sign on the dotted line, make sure you understand the terms, risks, and responsibilities that come with it. And if you’re still unsure, don’t hesitate to reach out to Umpqua or a financial advisor for guidance.

So, what are you waiting for? Take the first step toward unlocking your home’s potential today. And hey, don’t forget to share this article with your friends and family who might benefit from it. Together, we can help more people take control of their finances!

Table of Contents

- What Exactly is a Umpqua Home Equity Line of Credit?

- Why Choose Umpqua Home Equity Line of Credit?

- Eligibility Requirements for Umpqua HELOC

- How Much Can You Borrow with Umpqua HELOC?

- How to Apply for Umpqua Home Equity Line of Credit

- Common Questions About Umpqua HELOC

- Alternatives to Umpqua HELOC

- Conclusion: Is Umpqua HELOC Right for You?

Article Recommendations