Redwood Credit Union Auto Loans: Your Ultimate Guide To Financing Your Dream Car

Redwood Credit Union auto loans are more than just financial products—they’re a gateway to realizing your dream of owning a car. Whether you're looking to buy a shiny new sedan or a rugged SUV, understanding how these loans work can save you time, money, and stress. In this article, we’ll break down everything you need to know about Redwood Credit Union's auto loan offerings, so you can make an informed decision. Let's dive in!

Buying a car is a big deal, and finding the right financing option can feel overwhelming. That's where Redwood Credit Union steps in. With their competitive rates and flexible terms, they aim to simplify the process for members. But how do their auto loans stack up against other lenders? And what makes them such a great choice? We’ve got all the answers you need right here.

Whether you're a first-time buyer or a seasoned car owner, this guide will walk you through the ins and outs of Redwood Credit Union auto loans. From eligibility requirements to application tips, we'll cover it all. So, buckle up—it’s going to be a smooth ride!

Read also:Battersea Park Millennium Arena Your Ultimate Guide To Londons Hidden Gem

Why Choose Redwood Credit Union for Your Auto Loan Needs?

When it comes to financing a car, you want a lender who understands your needs and offers fair terms. Redwood Credit Union stands out because of its member-focused approach, which prioritizes affordability and convenience. Here’s why they’re worth considering:

First off, Redwood Credit Union offers some of the most competitive interest rates in the industry. They also provide personalized service, meaning you won’t get lost in the shuffle like you might with a big bank. Plus, as a credit union, they reinvest profits back into their community, making them a socially responsible choice.

Key Benefits of Redwood Credit Union Auto Loans

Let’s take a closer look at what makes Redwood Credit Union auto loans so appealing:

- Low interest rates designed to fit your budget

- No hidden fees—what you see is what you pay

- Flexible repayment terms tailored to your financial situation

- Convenient online application process

- Excellent customer support to guide you every step of the way

These benefits add up to a stress-free borrowing experience that puts you in control of your financial future.

Eligibility Requirements for Redwood Credit Union Auto Loans

Before you start dreaming about that new car, let’s talk about who qualifies for Redwood Credit Union auto loans. First things first—you need to be a member of the credit union. Membership is open to anyone living, working, or worshipping in certain counties in California, including Sonoma, Marin, and Napa.

Once you’re a member, you’ll need to meet a few basic criteria:

Read also:Benson Boone Revolutionizing The Industry Plant Sector With Cuttingedge Innovations

- Have a stable income source

- Provide proof of insurance for the vehicle you plan to purchase

- Have a good credit score (though Redwood Credit Union does offer options for borrowers with less-than-perfect credit)

Don’t worry if you’re not sure whether you qualify. Redwood Credit Union has friendly advisors who can help you determine your eligibility and guide you through the application process.

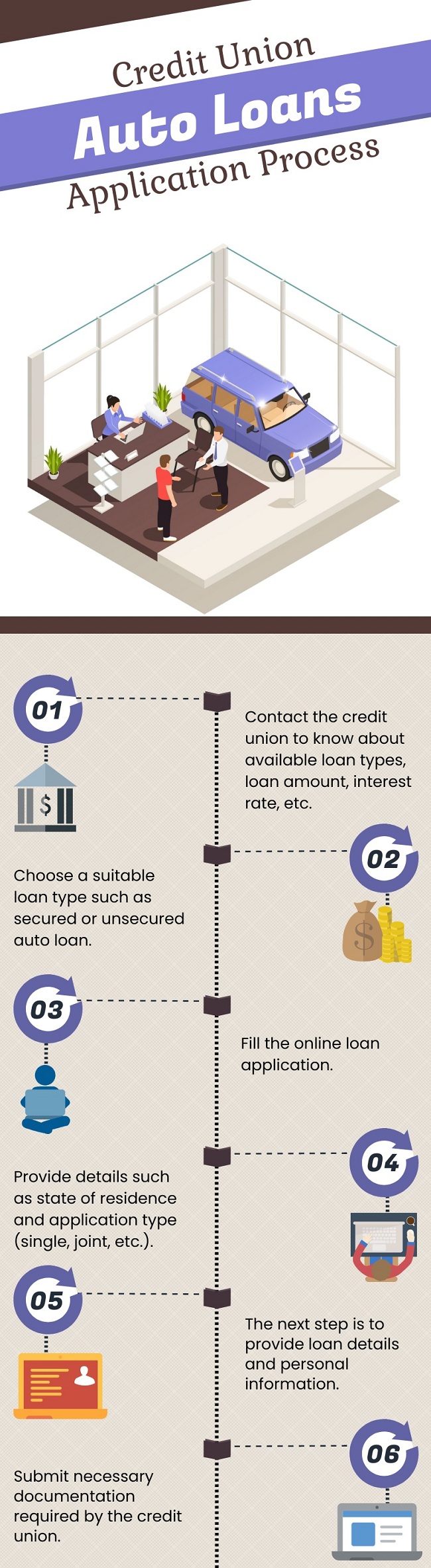

How to Apply for Redwood Credit Union Auto Loans

Applying for a Redwood Credit Union auto loan is easier than you might think. You can apply online, over the phone, or in person at one of their branches. Here’s a quick rundown of the steps:

Step 1: Gather your documents. You’ll need proof of income, identification, and details about the car you’re purchasing.

Step 2: Fill out the application. Whether you’re applying online or in person, the process is straightforward and user-friendly.

Step 3: Wait for approval. Once you submit your application, Redwood Credit Union will review it and get back to you quickly.

Step 4: Sign the paperwork. If approved, you’ll finalize the loan by signing the necessary documents.

Tips for a Successful Application

Here are a few tips to increase your chances of getting approved:

- Make sure your credit report is up-to-date and accurate

- Provide all requested documentation promptly

- Be honest and transparent about your financial situation

By following these tips, you’ll set yourself up for success and avoid unnecessary delays.

Understanding the Loan Terms and Conditions

Every loan comes with terms and conditions, and Redwood Credit Union is no exception. Here’s what you need to know:

Interest Rates: Redwood Credit Union offers some of the lowest interest rates in the industry, often below 4%. The exact rate you receive will depend on factors like your credit score and the loan term.

Loan Terms: You can choose from a variety of repayment terms, ranging from 24 to 72 months. Longer terms mean lower monthly payments, but you’ll pay more in interest over time.

Prepayment Penalties: One of the best things about Redwood Credit Union auto loans is that there are no prepayment penalties. This means you can pay off your loan early without incurring extra fees.

What Happens If You Miss a Payment?

Missing a payment can have serious consequences, including late fees and damage to your credit score. However, Redwood Credit Union offers hardship programs for members who find themselves in tough financial situations. If you’re struggling to make payments, don’t hesitate to reach out to them for assistance.

Redwood Credit Union Auto Loans vs. Other Lenders

How do Redwood Credit Union auto loans compare to those offered by other lenders? Let’s break it down:

Compared to big banks, Redwood Credit Union typically offers lower interest rates and more personalized service. Unlike online lenders, they have physical branches where you can meet face-to-face with advisors. And unlike dealership financing, Redwood Credit Union gives you the freedom to shop around for the best deal without being tied to a specific seller.

Of course, every lender has its pros and cons. But for many people, Redwood Credit Union strikes the perfect balance between affordability, convenience, and customer service.

Customer Reviews and Testimonials

Don’t just take our word for it—here’s what some satisfied Redwood Credit Union members have to say:

- “Their rates were unbeatable, and the staff was incredibly helpful.”

- “I was able to get pre-approved in just a few minutes online.”

- “They worked with me when I hit a rough patch financially.”

These testimonials highlight the exceptional service and flexibility that Redwood Credit Union is known for.

Common Questions About Redwood Credit Union Auto Loans

Still have questions? Here are answers to some frequently asked ones:

Can I Get a Loan with Bad Credit?

Yes, Redwood Credit Union offers options for borrowers with less-than-perfect credit. While you may not qualify for the lowest rates, they’ll work with you to find a solution that fits your needs.

Do I Need to Be a Member to Apply?

Yes, you must be a member of Redwood Credit Union to apply for an auto loan. However, joining is easy and comes with plenty of other benefits, like access to savings accounts and personal loans.

What Documentation Do I Need?

You’ll need to provide proof of income, identification, and details about the car you’re purchasing. Specific requirements may vary depending on your situation, so it’s a good idea to check with Redwood Credit Union beforehand.

Final Thoughts: Why Redwood Credit Union Auto Loans Are Worth It

Redwood Credit Union auto loans offer a winning combination of affordability, flexibility, and personalized service. Whether you’re buying a new car or refinancing an existing loan, they have options that fit your needs and budget.

So, what are you waiting for? Visit Redwood Credit Union’s website or stop by a branch today to learn more. And don’t forget to share this article with friends and family who might benefit from it. Together, let’s make smart financial decisions that keep us moving forward!

Remember, buying a car is a big decision, and choosing the right financing is just as important. With Redwood Credit Union auto loans, you can drive away confident that you made the best choice for your wallet—and your peace of mind.

Table of Contents

- Redwood Credit Union Auto Loans: Your Ultimate Guide to Financing Your Dream Car

- Why Choose Redwood Credit Union for Your Auto Loan Needs?

- Key Benefits of Redwood Credit Union Auto Loans

- Eligibility Requirements for Redwood Credit Union Auto Loans

- How to Apply for Redwood Credit Union Auto Loans

- Understanding the Loan Terms and Conditions

- Redwood Credit Union Auto Loans vs. Other Lenders

- Common Questions About Redwood Credit Union Auto Loans

- Final Thoughts: Why Redwood Credit Union Auto Loans Are Worth It

Article Recommendations