Amended Tax Return In VA: A Simple Guide To Fixing Your Tax Mistakes

Let’s be honest—tax season can get messy, especially when you’re dealing with state taxes like in Virginia. If you’ve already filed your VA tax return but realized there’s an error, don’t panic. Filing a VA tax amended return is not only possible but also relatively straightforward if you know what to do. In this article, we’ll break down everything you need to know about amending your Virginia tax return, from when to file to how to avoid common mistakes.

Picture this: You’ve just finished filing your Virginia state taxes and are ready to move on with life. But wait! You notice a mistake—maybe it’s a missing deduction, an incorrect income figure, or even a simple typo. What now? This is where an amended return comes into play. It’s like hitting the rewind button on your tax submission so you can fix those pesky errors.

Now, I know what you’re thinking—“Isn’t this going to be a headache?” Not necessarily. With the right steps and a little patience, amending your VA tax return can be a breeze. So grab a cup of coffee, sit back, and let’s dive into the nitty-gritty details of VA tax amended returns.

Read also:Prizm Football Fat Pack The Ultimate Guide For Sports Enthusiasts

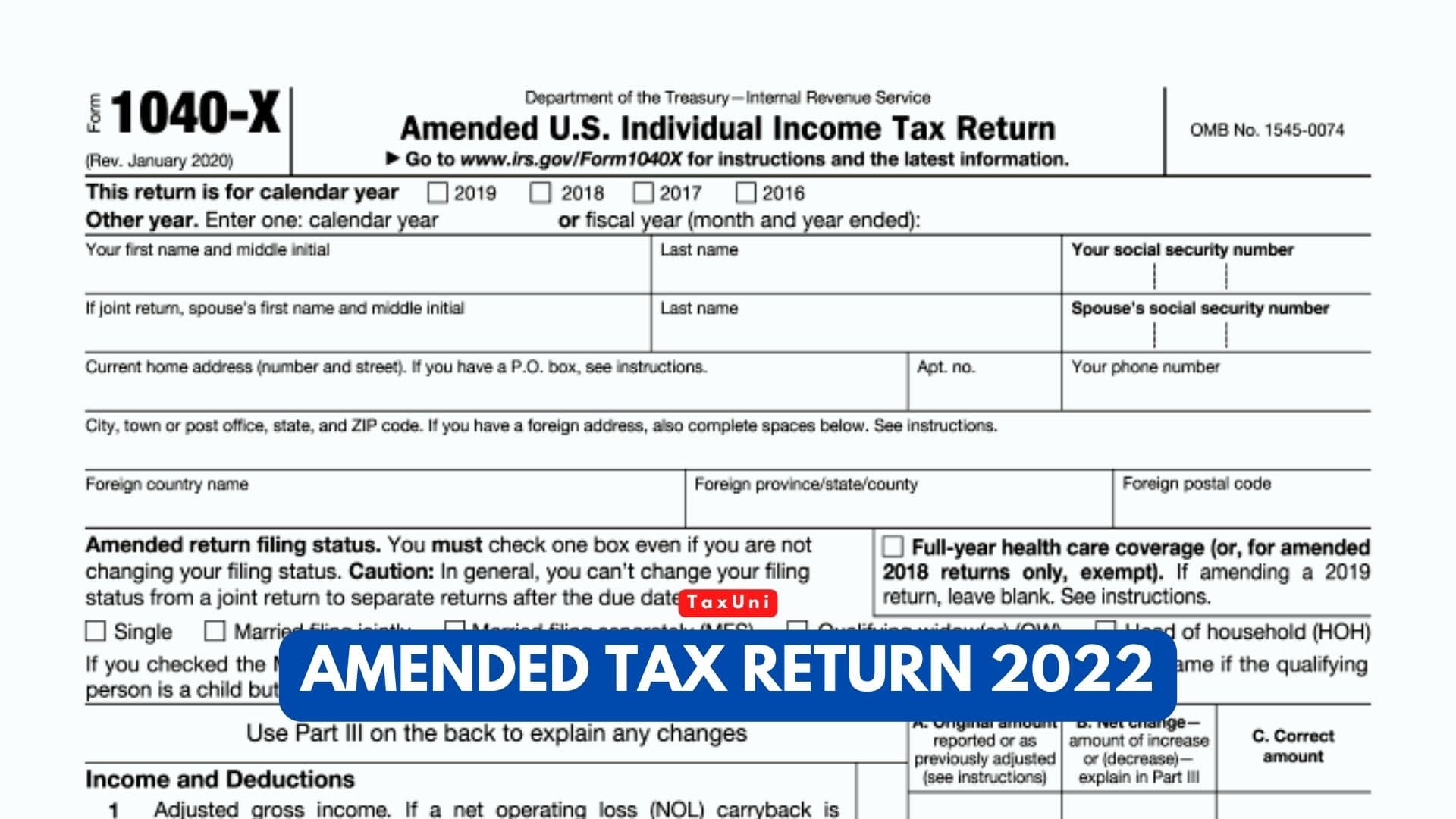

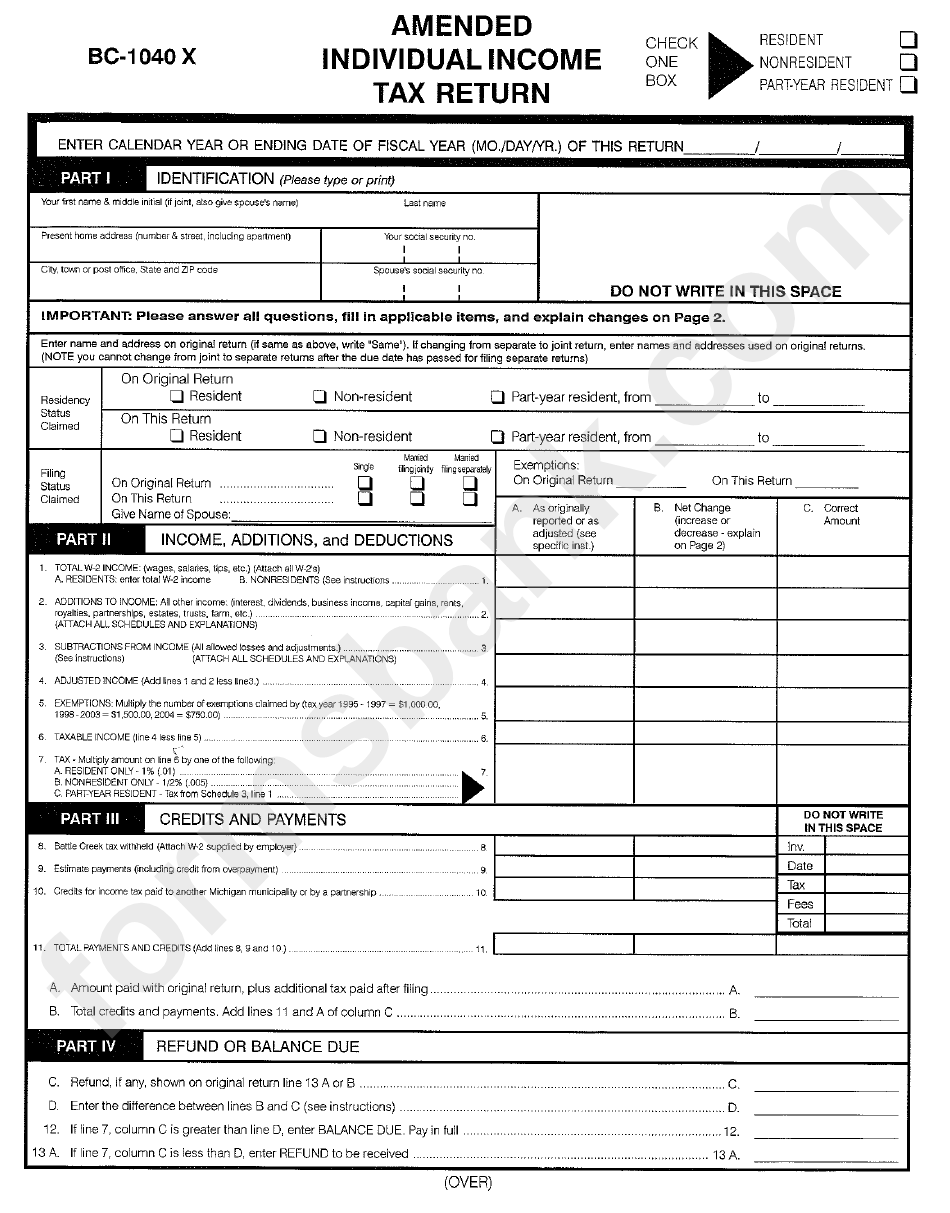

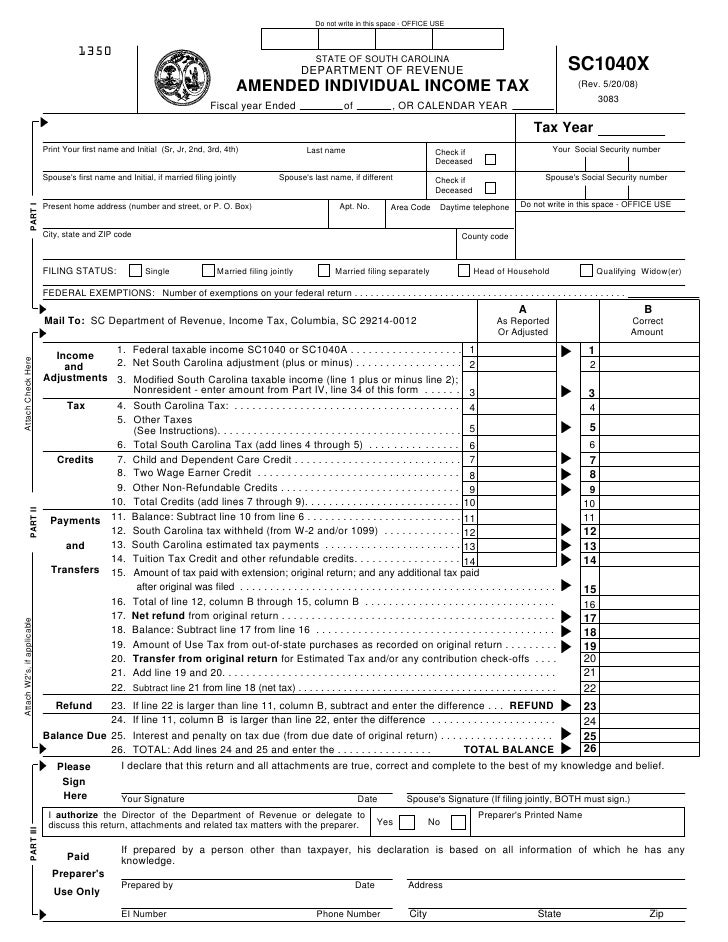

What is a VA Tax Amended Return?

A VA tax amended return is essentially a way to correct any errors or omissions in your previously filed Virginia state tax return. Think of it as a safety net for when things don’t go exactly as planned during tax season. Whether it’s a miscalculation, missing documentation, or even a change in your financial situation, an amended return allows you to update your records with the Virginia Department of Taxation.

But here’s the kicker—you can’t just submit an amended return for fun. There must be a valid reason, such as:

- Correcting income or deduction amounts

- Updating your filing status (e.g., switching from single to married filing jointly)

- Reporting additional tax credits or deductions

- Fixing errors in dependent information

Remember, accuracy matters. Even small mistakes can lead to bigger problems down the road, so it’s always better to address them sooner rather than later.

When Should You File a VA Tax Amended Return?

Timing is everything when it comes to amending your VA tax return. Ideally, you should file your amended return as soon as possible after discovering the error. Why? Because the longer you wait, the more complicated things might get—especially if it affects your federal return as well.

Here’s a quick tip: If you owe additional taxes due to the amendment, try to pay them early to avoid interest and penalties. On the flip side, if you’re owed a refund, filing promptly ensures you get your money faster.

Key Deadlines to Keep in Mind

While there’s no specific deadline for filing an amended VA tax return, you should aim to submit it within three years of your original filing date. This timeframe aligns with the statute of limitations for claiming refunds, so make sure you act quickly if you’re expecting money back.

Read also:You Smoked Then Ate Seven Bars Of Chocolate Lyrics A Deep Dive Into The Melancholic Anthem

How to File a VA Tax Amended Return

Filing a VA tax amended return isn’t as scary as it sounds. Here’s a step-by-step guide to help you navigate the process:

- Gather all necessary documents, including your original VA tax return, W-2 forms, 1099s, and any other relevant paperwork.

- Complete Form VA-760-AMC, which is specifically designed for amending Virginia state tax returns. You can download this form from the Virginia Department of Taxation website.

- Highlight the changes you’re making in your amended return. Be clear and concise—this will save both you and the tax department a lot of headaches.

- Submit your completed form along with any supporting documents to the appropriate address. Make sure to keep a copy for your records.

Pro tip: Double-check everything before sending it off. Trust me, you don’t want to amend an amendment!

Can You File Electronically?

Unfortunately, Virginia doesn’t currently offer electronic filing for amended returns. You’ll need to submit your paperwork by mail. However, this gives you the opportunity to personalize your submission and include any additional notes if needed.

Common Mistakes to Avoid When Amending Your VA Tax Return

Before you dive headfirst into amending your VA tax return, let’s talk about some common pitfalls to avoid:

- Forgetting to update both your federal and state returns if the error affects both.

- Not providing sufficient documentation to support your changes.

- Making new mistakes while trying to fix old ones—always triple-check your numbers!

- Missing the three-year deadline for claiming refunds.

By staying vigilant and organized, you can minimize the risk of these mistakes and ensure a smoother process overall.

Do You Need Professional Help?

Amending a tax return can sometimes feel overwhelming, especially if the errors are significant or complex. That’s where professional help comes in. A certified public accountant (CPA) or tax attorney can guide you through the process, ensuring everything is done correctly and efficiently.

But let’s be real—hiring a pro isn’t cheap. If your amendment is relatively simple, you might be able to handle it on your own. Just make sure you feel confident in your ability to navigate the paperwork.

What to Look for in a Tax Professional

If you decide to seek professional assistance, here are a few things to consider:

- Experience with Virginia state taxes

- Good reputation and positive client reviews

- Transparent pricing structure

- Availability to answer questions and provide ongoing support

Remember, the right professional can save you time, money, and stress in the long run.

Understanding VA Tax Laws and Regulations

To truly master the art of amending your VA tax return, it helps to have a basic understanding of Virginia’s tax laws and regulations. While we won’t bore you with every detail, here are a few key points to keep in mind:

- Virginia uses a progressive tax system, meaning your tax rate increases as your income rises.

- Certain deductions and credits are unique to Virginia, such as the earned income credit and the subtraction modification for federal retirement income.

- Failure to comply with state tax laws can result in penalties, interest, and other consequences.

Stay informed and proactive to avoid any unpleasant surprises during tax season.

How Do VA Taxes Compare to Other States?

Compared to some states, Virginia’s tax system is relatively straightforward. However, it’s still important to understand how it stacks up against neighboring states. For example, Virginia offers a homestead exemption for property taxes, which can be a significant benefit for homeowners.

Benefits of Amending Your VA Tax Return

While no one enjoys dealing with taxes, amending your VA tax return can actually offer several benefits:

- Correcting errors ensures you’re paying the right amount of taxes and avoids potential penalties.

- Claiming additional deductions or credits can result in a larger refund.

- Updating your records provides peace of mind and helps prevent future issues.

Think of it as tidying up your financial house—every little bit counts.

Tips for Preventing Future Tax Mistakes

Now that you’ve learned how to amend your VA tax return, let’s talk about how to prevent mistakes in the first place:

- Keep detailed records of all your financial transactions throughout the year.

- Use tax preparation software or consult with a professional to ensure accuracy.

- Stay informed about changes in tax laws and regulations that could affect your return.

A little extra effort upfront can save you a lot of trouble later on.

Staying Organized Year-Round

One of the best ways to avoid tax mistakes is to stay organized year-round. Set aside time each month to review your finances, update your records, and prepare for tax season. Trust me, your future self will thank you.

Conclusion: Take Control of Your VA Taxes

Amending your VA tax return may seem intimidating at first, but with the right approach, it’s completely manageable. By understanding the process, avoiding common mistakes, and seeking professional help when needed, you can ensure your taxes are accurate and up-to-date.

So what are you waiting for? Take control of your financial future by addressing any errors in your VA tax return. And don’t forget to share this article with friends and family who might find it helpful. After all, knowledge is power—and power pays off!

Table of Contents

- What is a VA Tax Amended Return?

- When Should You File a VA Tax Amended Return?

- How to File a VA Tax Amended Return

- Common Mistakes to Avoid When Amending Your VA Tax Return

- Do You Need Professional Help?

- Understanding VA Tax Laws and Regulations

- Benefits of Amending Your VA Tax Return

- Tips for Preventing Future Tax Mistakes

- Staying Organized Year-Round

- Conclusion: Take Control of Your VA Taxes

Article Recommendations