BMI Payment Schedule 2024: Your Ultimate Guide To Understanding And Managing Your Payments

So listen up, folks. If you're here because you're scratching your head about the BMI Payment Schedule 2024, you're not alone. It's like trying to decode a secret language sometimes. But don't sweat it. This guide is here to break it down for you in a way that's as easy as pie. Whether you're just curious or you're actually dealing with BMI payments, we've got you covered.

Let’s face it, managing finances can be a real headache. Especially when terms like "BMI Payment Schedule" start popping up. But hey, knowledge is power, right? And in 2024, staying on top of your BMI payments could mean the difference between financial peace and unnecessary stress. So, let's dive in and make sure you're fully equipped.

Before we get into the nitty-gritty, let’s just say this: understanding your BMI Payment Schedule 2024 isn’t just about numbers. It’s about taking control of your financial situation and making informed decisions. Stick around, and we’ll help you navigate through this like a pro.

Read also:Bear Attack In Glacier A Chilling Encounter In The Wild

What Exactly is BMI Payment Schedule 2024?

Alright, let’s start with the basics. BMI Payment Schedule 2024 refers to the timeline and structure of payments associated with Body Mass Index-related programs, insurance, or any other financial obligations tied to health metrics. Think of it as a roadmap that outlines when and how much you need to pay. And trust me, having a clear understanding of this schedule can save you from unexpected surprises down the road.

In simpler terms, if you’re involved in any health-related financial plan—whether it’s insurance premiums, gym memberships, or wellness programs—you’ll want to know exactly what’s coming your way in 2024. This isn’t just about numbers; it’s about planning your finances smartly.

Why Should You Care About BMI Payment Schedule?

Here’s the deal: ignoring your BMI Payment Schedule can lead to missed payments, penalties, or even worse, damaged credit. Yikes! On the flip side, staying informed can help you budget better, avoid unnecessary fees, and even negotiate better terms with providers. So, yeah, it’s kinda a big deal.

Plus, in 2024, with the increasing focus on health and wellness, many programs are tying financial benefits to maintaining a healthy BMI. That means your payment schedule could directly impact your wallet—and your health. Talk about a win-win situation if you play your cards right!

Breaking Down the BMI Payment Schedule 2024

Now that we’ve covered the basics, let’s get into the specifics. The BMI Payment Schedule 2024 typically includes several key components:

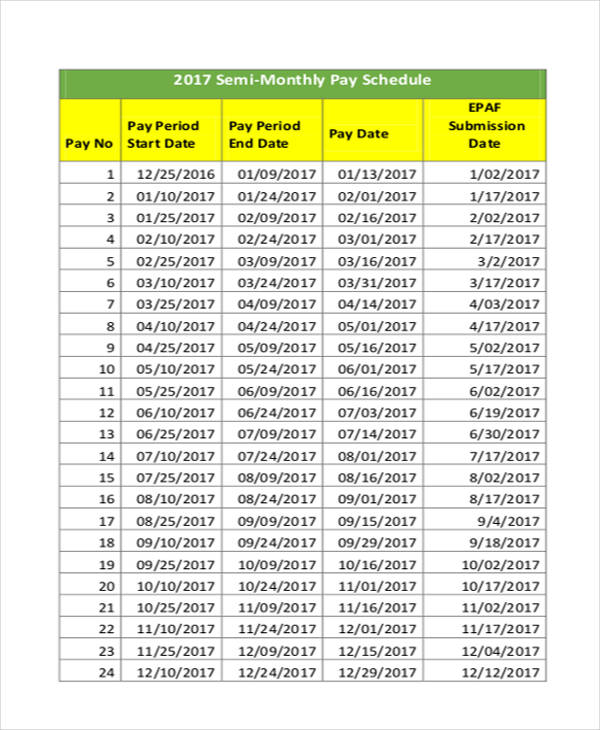

- Payment Due Dates: These are the dates when your payments are expected. Missing them can lead to penalties, so mark them on your calendar.

- Payment Amounts: This is the amount you’re required to pay. It could vary based on your plan, BMI category, or other factors.

- Payment Methods: From online banking to automatic deductions, knowing your options can make the process smoother.

- Grace Periods: Some plans offer a grace period if you miss a payment. It’s like a safety net, but don’t rely on it too much.

Understanding these components can help you stay on top of your game and avoid any unpleasant surprises.

Read also:What Is A Yogurt Male Unveiling The Mystery Of Yogurt Men In Modern Times

How to Read Your BMI Payment Schedule?

Reading your BMI Payment Schedule might seem intimidating at first, but it’s simpler than you think. Here’s a quick breakdown:

- Look for the payment frequency—monthly, quarterly, or annually.

- Check for any adjustments based on your BMI improvements or changes.

- Review any additional fees or penalties for late payments.

By breaking it down like this, you can easily understand what’s expected of you and plan accordingly.

Tips for Managing Your BMI Payment Schedule 2024

Managing your BMI Payment Schedule doesn’t have to be a chore. Here are some tips to help you stay organized and stress-free:

- Set Up Automatic Payments: This ensures you never miss a payment and avoids late fees.

- Create a Budget: Allocate a specific portion of your income towards these payments to avoid overspending.

- Monitor Your BMI: Keeping track of your BMI can help you qualify for better payment terms or discounts.

- Communicate with Providers: If you’re facing financial difficulties, reach out to your provider to discuss possible adjustments.

These simple steps can make a world of difference in managing your payments effectively.

Common Mistakes to Avoid

Let’s talk about some common pitfalls people fall into when dealing with BMI Payment Schedules:

- Ignoring Payment Due Dates: This can lead to penalties and affect your credit score.

- Not Reviewing the Schedule Regularly: Things can change, and staying updated is crucial.

- Overlooking Additional Fees: These can add up quickly if you’re not careful.

Avoiding these mistakes can save you a lot of headache in the long run.

Understanding the Impact of BMI on Payments

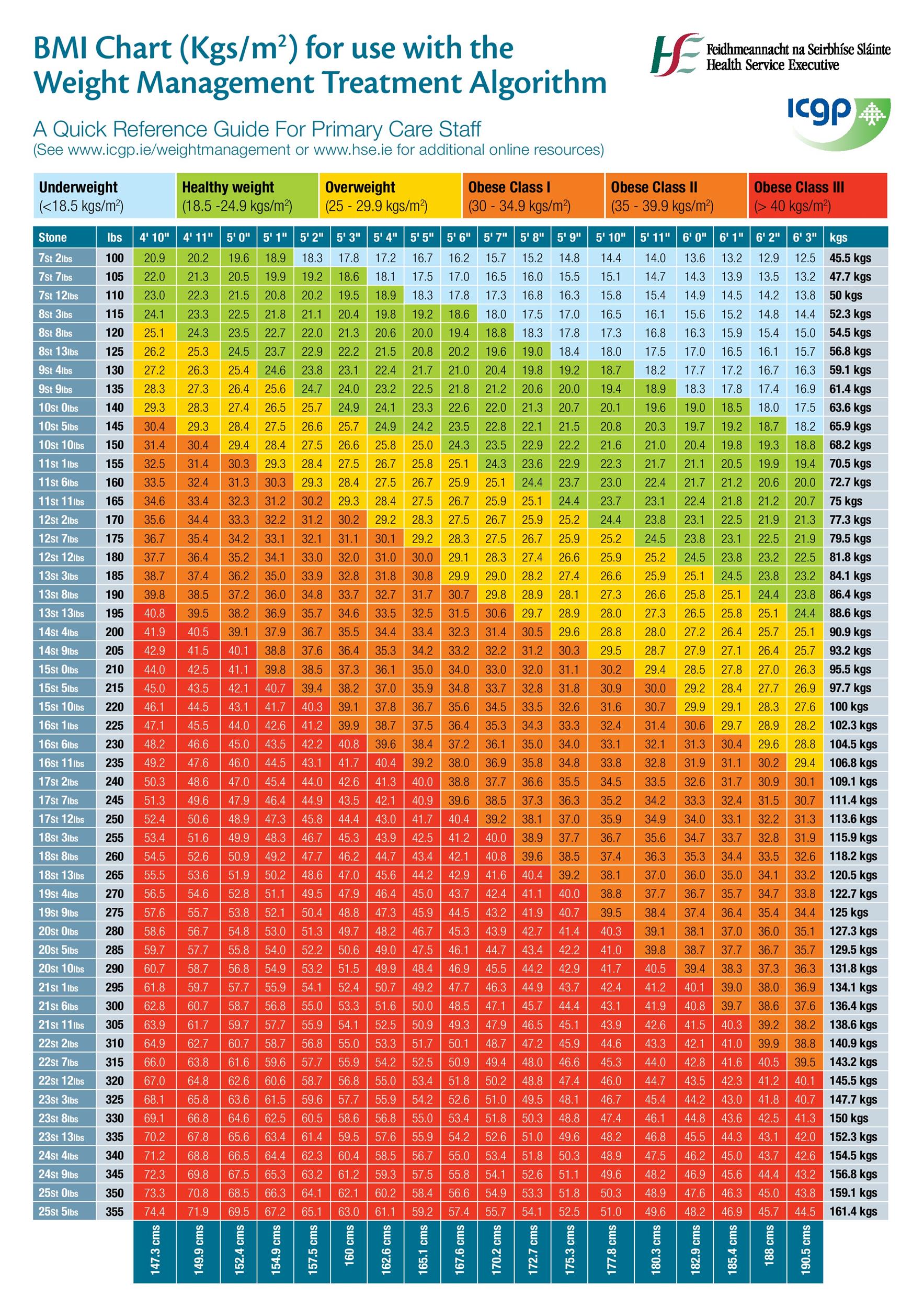

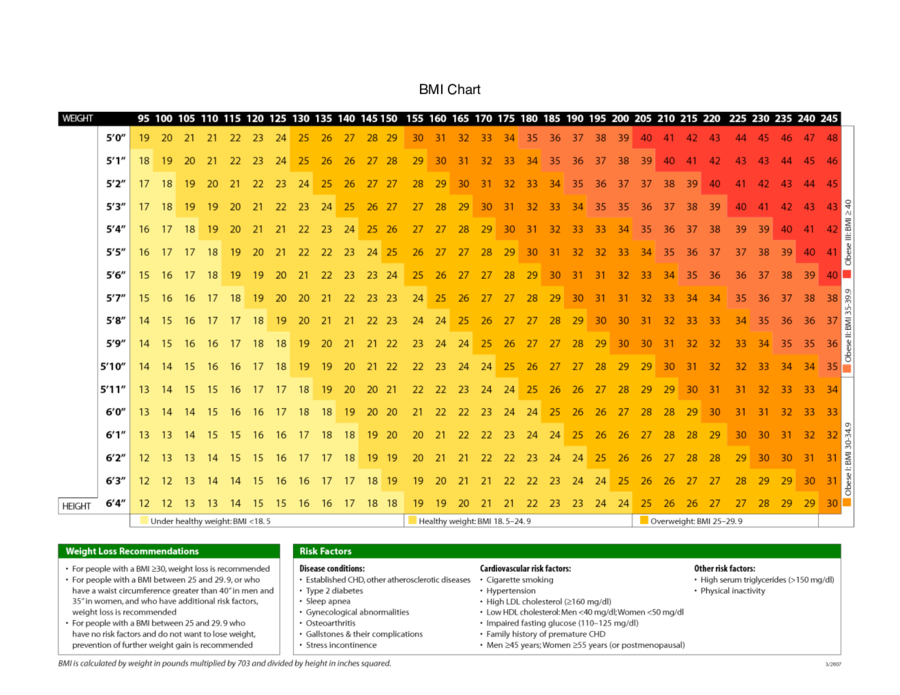

Your BMI doesn’t just affect your health; it can also impact your financial obligations. In 2024, many insurance providers and wellness programs are linking payment structures to BMI categories. Here’s how it works:

- Lower BMI: Often associated with lower premiums and better payment terms.

- Higher BMI: May result in higher premiums or stricter payment schedules.

So, maintaining a healthy BMI isn’t just good for your body; it’s good for your wallet too.

How to Improve Your BMI for Better Payments?

If you’re looking to improve your BMI and secure better payment terms, here are some actionable tips:

- Adopt a Balanced Diet: Focus on nutrient-rich foods and avoid processed junk.

- Exercise Regularly: Even a 30-minute walk daily can make a difference.

- Consult a Professional: Sometimes, expert guidance can help you achieve your goals faster.

By making these changes, you can not only improve your health but also save money in the long run.

Exploring Payment Options and Discounts

Did you know that many providers offer discounts or flexible payment options based on your BMI? Here’s what you need to know:

- Discount Programs: Some providers offer reduced rates for maintaining a healthy BMI.

- Flexible Payment Plans: If you’re facing financial challenges, you might qualify for a more flexible payment schedule.

- Wellness Incentives: Participating in wellness programs can lead to additional discounts or rewards.

Exploring these options can help you find the best deal for your situation.

Negotiating Your Payment Schedule

If you’re struggling to meet your BMI Payment Schedule 2024, don’t hesitate to negotiate. Here’s how:

- Reach Out Early: Contact your provider as soon as you foresee any issues.

- Be Honest: Share your financial situation openly and honestly.

- Ask for Alternatives: Inquire about possible adjustments or alternative payment plans.

Many providers are willing to work with you if you communicate effectively.

Staying Informed About BMI Payment Trends in 2024

2024 is shaping up to be a year of change in the health and finance sectors. Here are some trends to watch out for:

- Increased Emphasis on Preventive Care: More programs are offering incentives for maintaining a healthy BMI.

- Technological Advancements: Apps and online tools are making it easier to track your BMI and manage payments.

- Regulatory Changes: Keep an eye on any new regulations that might affect your payment schedule.

Staying informed about these trends can help you adapt and make the most of your financial situation.

Where to Find Reliable Information?

When it comes to BMI Payment Schedule 2024, reliable information is key. Here are some trusted sources:

- Your Provider’s Website: Always check here for official updates and resources.

- Government Health Websites: These often provide valuable insights and guidelines.

- Financial Advisors: Consulting with a professional can give you personalized advice.

Using these sources can ensure you’re getting accurate and up-to-date information.

Final Thoughts on BMI Payment Schedule 2024

And there you have it, folks. The BMI Payment Schedule 2024 might seem like a lot to handle, but with the right approach, it’s totally manageable. By understanding your schedule, staying organized, and taking proactive steps, you can ensure your finances are in good shape.

So, what’s next? We encourage you to take action. Whether it’s setting up automatic payments, reviewing your schedule regularly, or reaching out to your provider for assistance, every step counts. And don’t forget to share this guide with anyone who might find it helpful. Together, we can all navigate the world of BMI payments with confidence.

Call to Action

Got questions or comments? Drop them below! We’d love to hear from you and help you out. And if you found this guide useful, be sure to check out our other articles for more tips and insights. Stay informed, stay healthy, and most importantly, stay financially savvy in 2024!

Table of Contents:

- What Exactly is BMI Payment Schedule 2024?

- Why Should You Care About BMI Payment Schedule?

- Breaking Down the BMI Payment Schedule 2024

- Tips for Managing Your BMI Payment Schedule 2024

- Understanding the Impact of BMI on Payments

- Exploring Payment Options and Discounts

- Staying Informed About BMI Payment Trends in 2024

- Final Thoughts on BMI Payment Schedule 2024

Article Recommendations